And a handy dashboard of all crucial dates and details

| How Xeroed saves you interest Compare features | Snowball | Avalanche | Xeroed |

| Smallest balances first | Highest APR first | Minimize interest cost | |

|

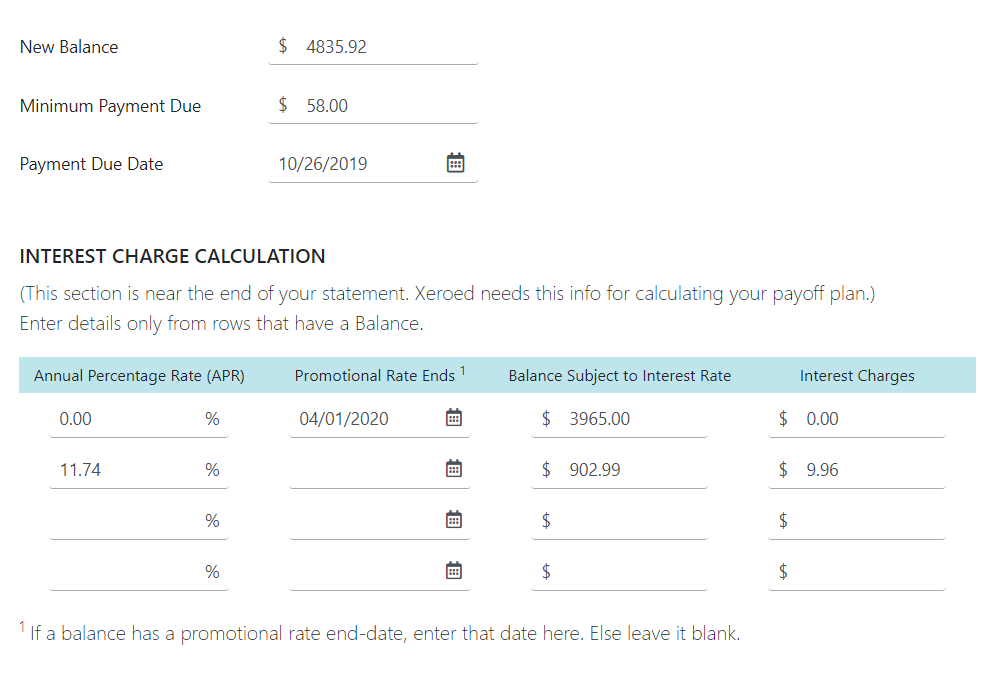

1 Tracks promotional APR expirations Pay off promos neither too early nor too late, by “looking ahead” at all your current and upcoming APRs to calculate the best interest saving. |

|||

|

2 Handles multiple APRs on the same card Account for the special way banks allocate your payment if the same card has multiple-rate balances (e.g. a promotional balance and a purchase). |

|||

|

3 Intelligently allocates extra payments Specify extra payments in some months and let the system decide how best to allocate them. |

Introducing Xeroed’s Skier – the “Look Ahead” debt payoff method.

Save more interest, and pay off your debts faster, than the Snowball & Avalanche methods.

The Snowball Method

Smallest balances first

Strategy: Pay off your debts in order of smallest balances first, regardless of interest rate, while making minimum payments on the other debts. Once the smallest balance is paid off, attack the next larger one, and so on.

Advantage: Helps you visually get rid of the smaller debts first.

Catch: If your larger debts have higher interest rates, you'll end up paying significantly more interest overall.

The Avalanche Method

Highest APR first

Strategy: Target debts with the highest interest rates first, regardless of balance remaining. Once you've paid off the debt with the highest APR, target the next lower one, and so on.

Advantage: If you don't have any promotional 0% APR or low-rate balances, nor plan to take any, this works well.

Catch: Ignores low APR promos till they expire and their APR shoots up, costing you high interest payment overall.

Xeroed’s Skier Method

Intelligently distributes payoff amounts

Strategy: Xeroed looks ahead through time at the current and upcoming APRs on your complete mix of loan and card balances, including any 0% / low-rate promotions (even on the same card). It then calculates how best to distribute your payoff budget into each card, each month.

Advantage: You get efficient, AI-optimized payoff plans: Interest-saving roadmaps through the projected payoff period. Pays off your promos neither too early nor too late.

You save by paying the least interest overall

The key: “Look ahead.”

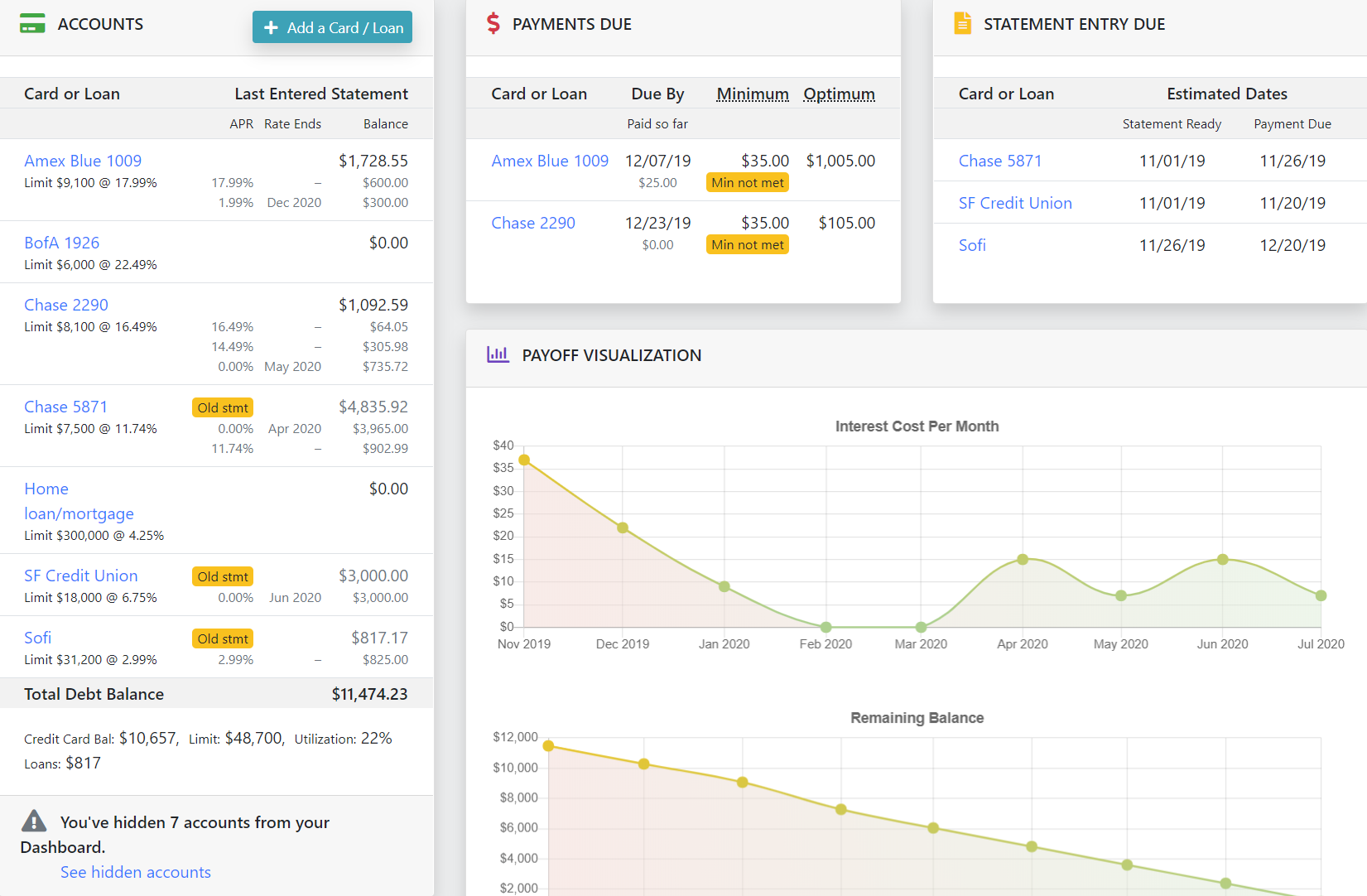

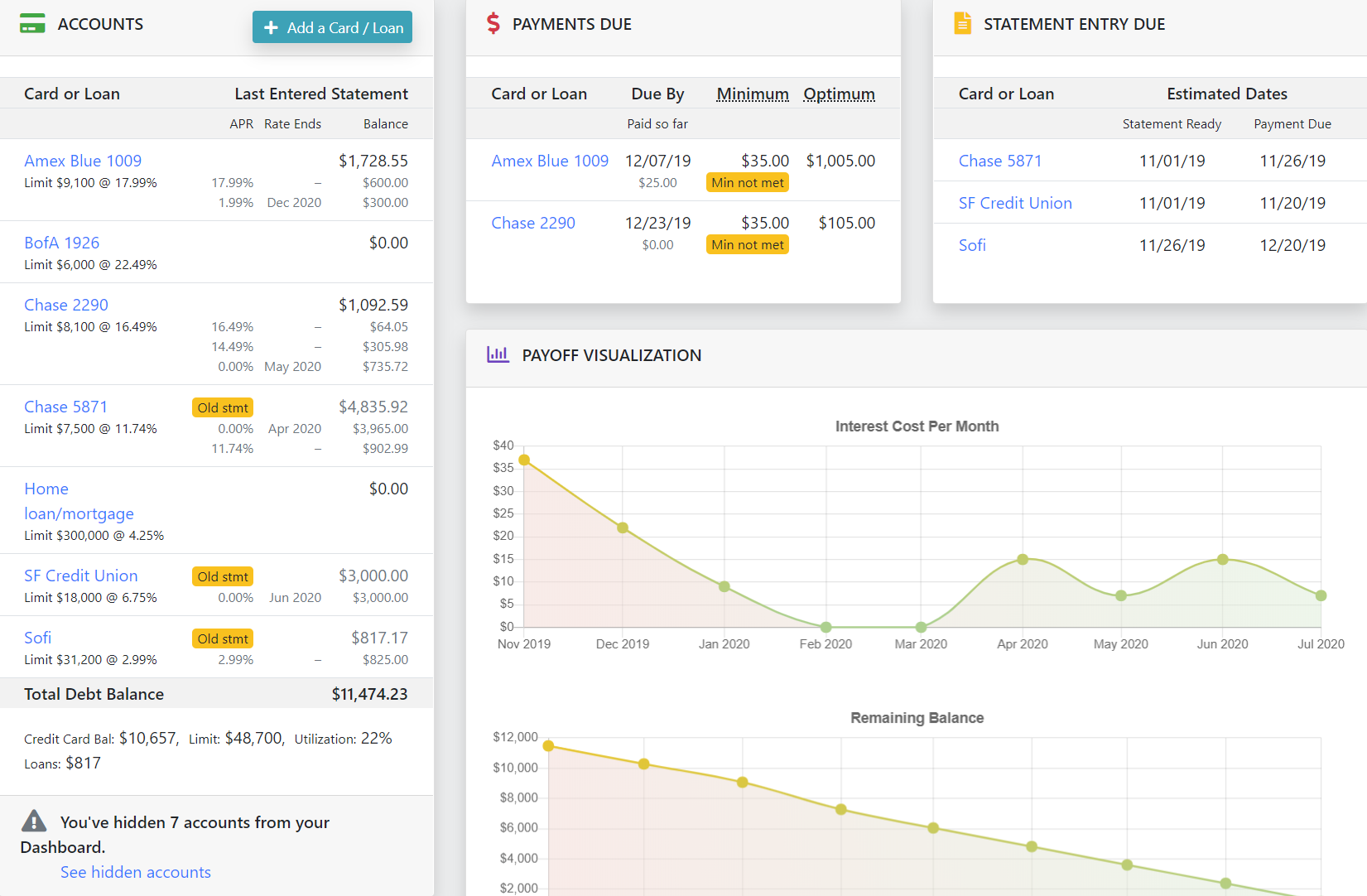

Handy dashboard

At-a-glance picture of crucial dates and key details – everything in one place.

AI-optimized payoff planning

Handles ANY scenario – no more guesswork! Xeroed calculates the least-interest payoff plans for you, for any mix of APRs, balances, and payoff budget.

Data safety

Xeroed never asks for your bank logins, SSN or any other confidential info. All calculations are done simply from the statements you enter.